What You Should Know About Financial Planning

You may have come across the term “financial planning” recently and wondered what it means. You may have decided to start your own financial plan but you’re not sure how. Or you may feel it’s time you went to a financial planner for some professional advice. Whatever your situation, the following information can help you decide what’s right for you.

What is Financial Planning?

Financial planning is the process of meeting your life goals through the proper management of your finances. It is a process that consists of specific steps that help you ascertain your financial condition objectively.

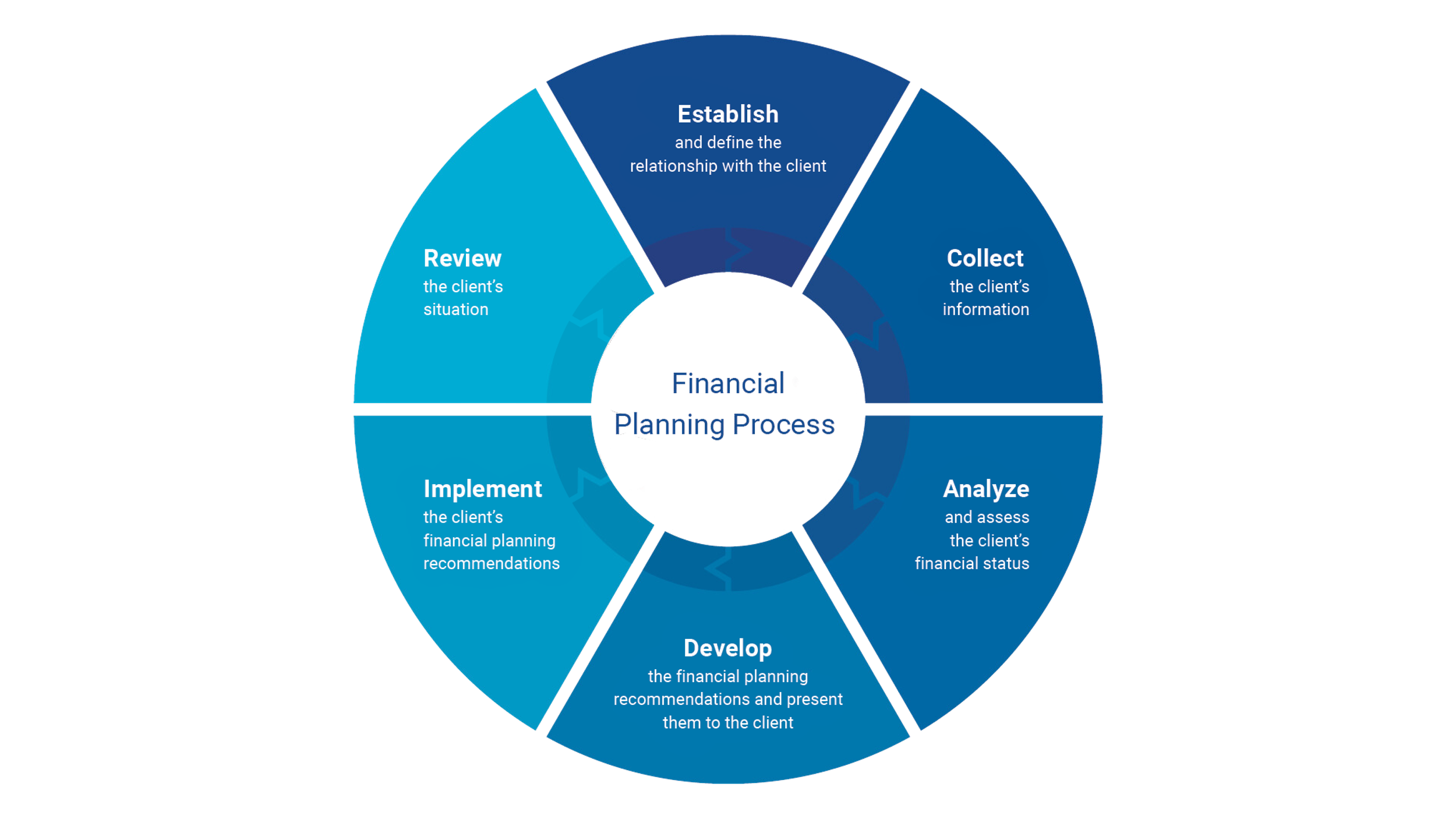

The financial planning process consists of six steps that help you take a big picture, look at where you are financially. Using these six steps, you can work out where you are now, what you may need in the future and what you must do to reach your goals.

The process involves gathering relevant information, setting life goals, examining your current financial status and coming up with a strategy or plan on how you can meet your current situation and future plans.

The Benefits of Financial Planning

Financial planning should provide direction and meaning to all your financial decisions. By viewing each financial decision as part of a whole, you can consider its short and long term effects on your life goals. You can therefore adapt more easily to life changes and feel more secure that your goals are on track.

Can You Do Your Own Financial Planning?

Some personal finance software packages, magazines or self-help books can help you do your own financial planning. However, you may decide to seek help from a professional financial planner if:

You need expertise you don’t possess in certain areas of your finances. For example, a planner can help you evaluate the level of risk in your investment portfolio or adjust your retirement plan due to changing family circumstances.

You want to get a professional opinion about the financial plan you developed for yourself.

You don't feel you have the time to spare to do your own financial planning.

You have an immediate need or unexpected life event such as birth, inheritance or major illness.

You feel that a professional adviser could help you improve on how you are currently managing your finances.

You know that you need to improve your current financial situation but don't know where to start.

What Is A Financial Planner?

A financial planner is someone who uses the financial planning process to help you figure out how to meet your life goals. The planner can take a “big picture” view of your financial situation and make financial planning recommendations that are right for you. The planner can look at all of your needs including budgeting and saving, taxes, investments, insurance and retirement planning. Or, the planner may work with you on a single financial issue but within the context of your overall situation. This big picture approach to your financial goals sets the planner apart from other financial advisers, who may have been trained to focus on a particular area of your financial life.

Be Sure You're Getting Financial Planning Advice

The government does not regulate financial planners as financial planners; instead, it regulates planners by the services they provide. For example, a planner who also provides securities transactions or advice is regulated as a stockbroker or investment adviser. As a result, the term “financial planner” may be used inaccurately. To be sure that you are getting financial planning advice, ask if the adviser follows the six elements of the financial planning process described below.

Financial Planning Process:

FPSB’s Financial Planning Process is a collaborative, iterative approach that financial planning professionals use to consider all aspects of a client’s financial situation when formulating financial planning strategies and making recommendations.

THE FINANCIAL PLANNING PROCESS CONSISTS OF THE FOLLOWING SIX ELEMENTS:

1. Establish and define the relationship with the client.

The financial planning professional informs the client about the financial planning process, the services the financial planning professional offers, and the financial planning professional’s competencies and experience.

The financial planning professional and the client mutually determine whether the services offered by the financial planning professional, together with the professional’s competencies and experience, support the financial planning professional providing the services requested or likely to be required by the client. The financial planning professional determines if there are any conflict(s) of interest and discloses them to the client.

The financial planning professional and the client mutually agree on the services to be provided during the financial planning engagement. The financial planning professional sets out in writing the agreed scope of the financial planning engagement before providing any services to the client, including details about: the responsibilities of each party (including third parties); the terms of the financial planning engagement; and compensation and conflict(s) of interest of the financial planning professional. The written scope of the financial planning engagement is signed by both parties, or accepted in writing by the client, and includes a process for either party to terminate the financial planning engagement.

2. Collect the client’s information.

The financial planning professional and the client identify and confirm the client’s stated personal goals. The financial planning professional confirms with the client that the likely effort needed to support the client in achieving those goals falls within the scope of the financial planning engagement.

The financial planning professional collects sufficient quantitative information about the client, and documents from the client relevant to the scope of the financial planning engagement, before making and/or implementing any financial planning recommendations.

The financial planning professional collects sufficient qualitative information about the client relevant to the scope of the financial planning engagement to understand how the client’s values, attitudes, expectations and financial experiences / literacy might impact financial planning recommendations or the client’s financial decision-making.

3. Analyze and assess the client’s financial status.

The financial planning professional assesses how the client’s current financial situation supports the client’s ability to achieve financial objectives and stated personal goals, and identifies additional financial resources needed by the client, if any.

4. Develop the financial planning recommendations and present them to the client.

The financial planning professional considers one or more strategies relevant to the client’s current situation that could reasonably meet the client’s objectives, needs and priorities; develops the financial planning recommendations based on the selected strategies to reasonably meet the client’s confirmed objectives, needs and priorities; and presents the financial planning recommendations and the supporting rationale in a way that allows the client to make an informed decision.

The financial planning professional assesses the opportunities, and identifies constraints and risks presented by the client’s financial situation and current course(s) of action, that may impact the client’s ability to achieve a financial objective and stated personal goal. This includes assessing the client’s ability, willingness or likelihood to respond to unexpected personal and financial events.

The financial planning professional and client consider one or more strategies relevant to the client’s current situation that could reasonably meet the client’s financial objectives and stated personal goals.

The financial planning professional identifies any financial objective that is not feasible or any short, mid or long-term stated personal goal(s) that does not appear to be realistic and discusses with the client how the stated personal goal(s) may need to be modified or abandoned.

The financial planning professional develops financial planning recommendations to reasonably meet the client’s financial objectives and stated personal goals, taking into account the client’s current situation, course(s) of action and selected strategies.

The financial planning professional presents the financial planning recommendations, and supporting rationales, in a way that allows the client to make an informed decision on whether the strategies will support achieving the client’s financial objectives and stated personal goals.

The financial planning professional discusses with the client the information, factors and assumptions that have been used to develop the financial planning recommendations and how the information, factors and assumptions could impact the client’s ability to reach financial objectives and stated personal goals.

The financial planning professional incorporates feedback from the client by mutually agreeing with the client on the type and scale of modifications to the financial planning recommendations, which could include the financial planning professional revising or re-prioritizing the client’s financial objectives or stated personal goals, or revising the scope of the financial planning engagement.

The financial planning professional informs the client that future changes in personal conditions or economic, political, or regulatory environments may affect financial planning recommendations, and gains the client’s support to review the client’s situation and financial planning recommendations on an ongoing basis, and to modify recommendations as required.

5. Implementing and Financial planning recommendations.

The financial planning professional and the client mutually agree on the financial planning recommendations and their prioritization, and on implementation responsibilities that are consistent with the scope of the financial planning engagement, which includes the financial planning professional’s ability to implement, or direct the implementation of, the financial planning recommendations.

The financial planning professional identifies and presents appropriate products or services to implement the financial planning recommendations.

6. Review the client’s situation.

The financial planning professional and client mutually define and agree on terms for the future review and evaluation of the client’s situation, including financial objectives and stated personal goals, personal risk profile, lifestyle and other relevant factors, and the client’s progress toward achieving stated personal goals.

The financial planning professional and the client mutually agree on whether, when and how to update the financial planning recommendations, based on changes in the client’s situation, financial objectives or stated personal goals, or in the economic, political or regulatory environment.