IBF Accreditation

About the Institute of Banking and Finance Singapore (IBF)

The Institute of Banking and Finance Singapore (IBF) was established in 1974 as a not-for-profit industry association to foster and develop the professional competencies of the financial sector. IBF represents the interests of close to 200-member financial institutions covering banks, insurance companies, securities brokerages and asset management firms.

In partnership with the financial industry and training providers, IBF is dedicated to empowering practitioners with capabilities to support the growth of the Asian financial industry and to promote the Asian standard of excellence for practitioners in finance.

Working hand-in-hand with the individual practitioner and the industry, IBF aims to elevate individual competency whilst raising industry standards.

ABOUT THE IBF STANDARDS

The IBF Standards represents a set of competency standards developed by the industry, for the industry. It provides a practice-oriented development roadmap for financial sector practitioners to attain the necessary training to excel in their respective job roles.

Covering 13 industry segments spanning more than 50 specializations, the IBF Standards offers a comprehensive suite of accredited training and assessment programmes to guide a financial sector practitioner from licensing examinations on through to professional certification across 3-levels:

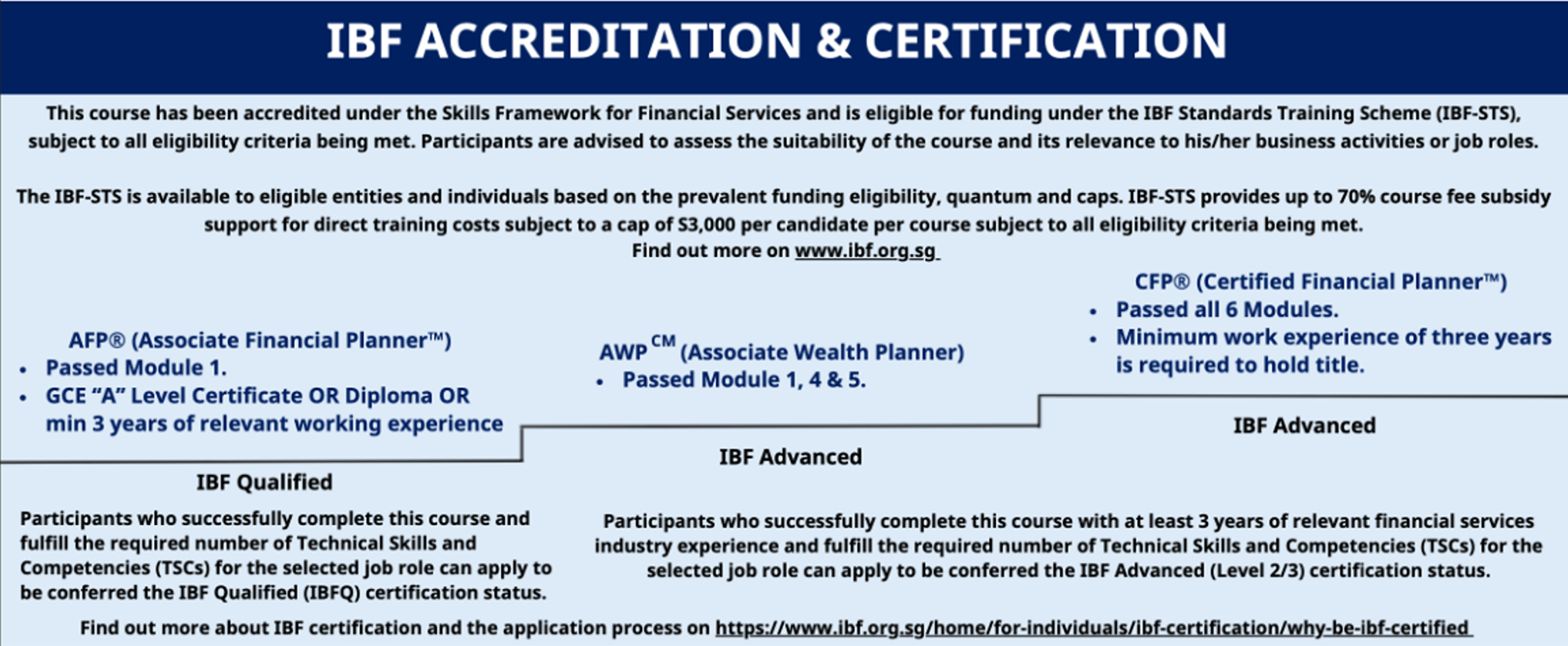

IBF Qualified

IBF Advanced

IBF Fellows

(for new interns)

(for senior practitioners and specialists)

(for industry veterans)

You may wish to refer to the IBF webpage for more information

IBF CERTIFICATION

1. IBF Qualified – Level 1

An IBF-certified practitioner is one who epitomizes the values of professional excellence, integrity and a strong commitment to industry development.

A practitioner with an IBF Qualified (IBFQ) certification status is one that is equipped with broad-based capabilities and foundation competencies to be ready to undertake new roles. Associate Financial PlannerTM, AFP® practitioner who successfully completes an IBF Level 1 CPD Training Programme will be eligible to apply the IBFQ certification.

The certified practitioner is entitled to use the qualification title “IBFQ” and the following certification

mark:

Application:

For new entrants with less than 3 years of financial services industry experience

• Certified upon successful completion of eligible IBF-STS accredited assessment course(s)* for

IBF Certification and attained the required skills for the selected industry segment and function

Criteria:

75% of Technical Skill Competencies (TSCs) within job role, including:

• Industry Rules & Regulations

• Product Knowledge

*TSCs for Product Knowledge and Rules & Regulations can be attained through either regulatory exams or training courses

2. IBF Advanced – Level 2

An IBF-certified practitioner is one who epitomizes the values of professional excellence, integrity and a strong commitment to industry development.

A practitioner with an IBFA certification status is an experienced practitioner and has acquired applied knowledge and complex analytical skills for specialists or supervisory functions.

Associate Wealth Planner, AWPCM who successfully completes an IBF Level 2 CPD Training Programme will be eligible to apply the IBF Advance (IBFA) certification.

The certified practitioner is entitled to use the qualification title “IBFA” and the following certification

mark:

Application:

For practitioners with 3 to 15 years of relevant experience in selected industry segment.

Application should be made within 5 years from the completion of the IBF-STS accredited programme.

Criteria:

75% of Technical Skill Competencies (TSCs) within job role

*TSCs for Product Knowledge and Rules & Regulations can be attained through either regulatory exams or training courses

3. IBF Advanced – Level 3

An individual who has demonstrated applied knowledge and advanced analytical skills for specialist or supervisory functions and with more than 7 years of experience in selected industry segment.

Certified Financial PlannerTM, CFP® who successfully completes an IBF Level 3 CPD Training Programme will be eligible to apply the IBF Advance (IBFA) certification.

The certified practitioner is entitled to use the qualification title “IBFA” and the following certification

mark:

Application:

For practitioners with more than 7 years of relevant experience in selected industry segment.

Criteria:

75% of Technical Skill Competencies (TSCs) within job role

*TSCs for Product Knowledge and Rules & Regulations can be attained through either regulatory exams or training courses

Continuing Professional Development (CPD) Obligations

All IBF-certified individuals are expected to achieve a minimum of 15 Continuing

Professional Development (“CPD”) hours annually. Details on eligible CPD activities can be found here:

Global excellence in financial planning